For a very long time the activity on the international financial markets has been dominated by expectations regarding the main central banks of developed economies maintaining accommodative monetary conditions. This translated both into an abundance of liquidity and a low cost of financing in the main international currencies, both of which represented stimuli for stock market activity, directly (liquid capitals in search of adequate financial returns increased the buying demand for many types of financial instruments, leading to the increase of quotations, indices, capitalization, and circulations), as well as indirectly (easy access to financing and its low cost fueled the issuers expectations regarding positive results).

The situation described above has been the main background note of developments in almost all segments of the international financial markets for many years. Even if along the way the economy and the stock markets faced exogenous shocks with a major impact, the fiscal and monetary response indirectly constituted a massive support for maintaining stock market trends, at least during the 2015-2021 period.

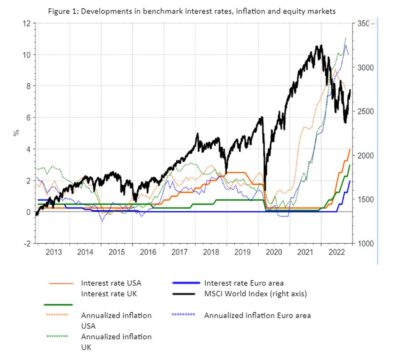

Of course, there are many other elements that have influenced stock market trends. Among the factors with an important positive influence was the rapid advance of technology companies, which during the pandemic and afterwards represented an important driver of the growth of stock indices, and, more recently, the increasing profitability of energy companies and those in the field goods and main raw materials (ores, agricultural products, construction materials, etc.). The initial pandemic shock acted very strongly in a negative sense, as can be seen on the graph below, its effect being major, but short-lived.

The graph below shows that although there have been periods with different peculiarities and characteristics, the implications being sometimes positive, sometimes negative for stock index quotations, however, in general, when monetary policy interest rates have been close to zero stock indices have recorded favorable developments in the medium term. Such examples are the recovery period of the stock markets after the two consecutive shocks represented by the global financial crisis and the European debt crisis, as well as the strong recovery of the indices after the initial pandemic shock, both visible on the chart.

Figure 1: Developments in benchmark interest rates, inflation and equity markets

The abundance of cheap money has influenced the evolution of many segments of the financial markets, not just the stock exchanges.

In a society that often has as its investment benchmark the hope of quick profit promoted in the virtual environment in many cases through deceptive techniques, there has been a significant influx to crypto-assets. The lack of understanding of the risks they induce, nor of the way in which they were constructed have made these instruments, regardless of the warnings of financial bodies, an investment destination for individuals looking for immediate gains.

The exceptional scale and dynamics that crypto assets have experienced would have been hard to imagine in a period of high interest rates and real positive returns for traditional assets, especially given the absence of a relevant connection to the real economy and as a result the inability of these instruments to generate consistent and long-term cash flows in the form of dividends, interest or a traditional form of operating profits for holders.

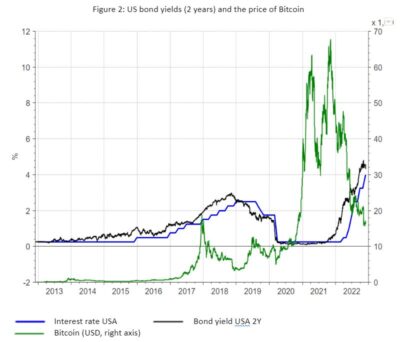

Analysis of the chart presented in figure 2 suggests that in the case of Bitcoin, the first and still one of the most representative crypto assets, both the high during 2021 and the previous relevant high in late 2017 were recorded even before the significant increase in bond yields. In the present graph, the sovereign bonds issued by the USA with a maturity of 2 years were used as a reference; the evolution of their yields is closely related to expectations of inflation dynamics and anticipates (by several months/quarters) changes in the key interest rate of the US central bank. The graph shows that the periods when the returns of these securities were trending above the 2% threshold were not positive for Bitcoin and the crypto asset market as a whole.

Figure 2: US bond yields (2 years) and the price of Bitcoin

Source: Refinitiv Datastream

Of course, we do not intend to formulate here a presumption regarding a possible causal link between the dynamics of the two variables presented, but economic rationality suggests as natural the observation that when money becomes more expensive, the appetite for investments in assets without a real economic foundation and at the same time unable to generate earnings from a core operating activity decreases.

Certainly, the problems of the crypto universe are much bigger than that, not coincidentally they also extend into the sphere of governance, transparency, and the inability to protect the interests and rights of the holders. Beyond this, however, at the principle level, the fact remains that when the cycle reverses and we enter a period of expensive money (whose duration we cannot yet anticipate), the available capital decreases and the selection is much more careful. Therefore, not all asset types can maintain favorable price developments.

A cartoon series created in the 1940s presented in numerous episodes the adventures of two main characters embodied by a bird (Road Runner) and its eternal foe, a coyote (Wile E. Coyote). The confrontation between the two always took place on the tops of rocks on the edge of a canyon, and the coyote was tricked by the Road Runner into running over the edge of the precipice. Thus, he remained temporarily suspended in the air. It wasn’t until he looked down and realized he had no support whatsoever that he fell into the canyon below.

In real life, many assets whose prices have skyrocketed and become disconnected from fundamentals for a long time as a result of the short-lived support given by cheap deflationary liquidity and near-zero interest rates are just going through such a “Wile E. Coyote moment” now that these incentives have begun to be withdrawn, both as a result of the need for fiscal consolidation (in most countries, with only a few exceptions) and to combat inflation.

The metaphor and the association between the cartoon character approach and economic-financial developments were used and consecrated by the laureate of the Nobel Prize for economics Paul Krugman (2007), but also by the chairman of the FED, Ben Bernanke (2018).

In the aftermath of the financial crisis of 2007, the rational-irrational duality in financial theory was brought back to the present. Traditionally, the analysis of the evolution of financial markets started from the presumption of the rationality of economic agents, ignoring other influences, although in the General Theory, Keynes addressed the notion of animal spirits. It is true that in his approach, even though Keynes states that “rationality is not sufficient to justify action”, he does not see animal spirits as belonging exclusively to the domain of irrationality, but as a need to act and make decisions despite the existence of uncertainty. In other words, investment decisions are built on animal spirits, given that a rational calculation does not justify decision-making and action in conditions of uncertainty.

Although easy to accept intuitively, the concept did not enjoy wide acceptance, and until the 1980s macroeconomic theory practically excluded the notion of animal spirits, classified as belonging to the realm of the irrational (Dow and Dow, 2011).

In the context of the financial crisis of 2007, the concept of animal spirits returns to attention (Akerloff and Shiller, 2009), true that this time against the background of the increased importance given to neuroeconomics. The concept of animal spirits arouses interest and is worth exploring, although there is still no question of a consensus in its definition, nor of a definitive implantation in the mainstream macroeconomic approach. In the view of Akerloff and Shiller (2009), a number of non-economic motivations play a decisive role – confidence, fairness, attitude towards corruption and bad faith, the “money illusion” related to the confusion between the nominal and the real level of prices, and human thinking essentially based on the pattern of a story, of one’s own life intertwined with those of others, aggregated into national or international narratives, with an impact on the economy. Non-economic motivations influence behavior and decision-making mechanisms; confidence and the resulting feedback between confidence and the economy magnify disturbances, and wage and price setting raise the issue of fairness. At the same time, the role played in the economy by the temptation of corruption and antisocial behavior cannot be neglected. These manifestations of the concept of animal spirits play a fundamental role in economics and have the potential to answer pressing questions where the rational approach has proven limited, from the causes of recession to the power exercised by central banks in the economy or prices volatility in the financial markets.

It seems that the traditional approach which called for confidence in the rationality of markets has been replaced by the newer, more attractive approach of market irrationality. We are therefore discussing a wide variety of research in behavioral finance, which applies various theories based on rationality or psychological factors in order to understand the functioning mechanisms of the markets and predict their evolution.

But Frydman and Goldberg (2007) find that in fact both approaches commit the same error, of assuming that markets behave mechanically and that fluctuations are predictable; they instead propose an approach based on the assumption that participants have imperfect knowledge, and aggregate models are built based on the individual behavior of agents. Models that seek to explain market changes based on representations of individual behaviors, although deeply embedded in economics, both in their traditional form and those based on behavioral theories, have the same flaw, namely, the change, the outcome they predict is constant different from market participants’ forecasts. Thus, models based on imperfect knowledge do not aim to accurately predict the changes that may occur in the markets, but provide a picture of the qualitative implications.

Even if Wile E. Coyote always falls into the abyss like some investors who do not properly calibrate the investments they make in moments of overlapping crises, the world economy and international financial markets will continue to function, with the support of appropriate policies, gradually adapting to a normality that they experienced some time before the global financial crisis, when both inflation and interest rates in developed economies were not quite as low as they were at the beginning of the pandemic.

But the support will be much more targeted, and markets can no longer count on the rescue of massive liquidity injections by many central banks in developed economies. We are entering a period where economic fundamentals will become relevant to more and more investors, which is not necessarily a bad thing. And where these foundations do not exist, expectations should be much more reserved than we have seen in recent years. The world of investing is a complex reality, and, as George Goodman said in The Money Game, “if you don’t know who you are, the stock market is an expensive place to find out”.

COMMENTS