The European Banking Authority (EBA) published on September 26 its second mandatory Basel III Monitoring Report which assesses the impact that Basel III full implementation will have on EU banks in 2028.

According to this assessment, which uses a sample of 157 banks for the point-in-time analysis, in terms of minimum Tier 1 capital the impact has significantly decreased in relation to the previous reference date of December 2021. In terms of estimated capital shortfall, the impact of the reform has been nearly fully absorbed.

Main results of the 2022 exercise

• The baseline impact assessment quantifies the difference in the Pillar 1 minimum required capital between the current EU implementation of the Basel standards (CRR 2/CRD 5) and the full Basel III implementation. To comply with the new framework, EU banks would combined

need a total of EUR 0.6 billion of additional Tier 1 capital at the full implementation date in 2028.

• The weighted average relative increase in total T1 MRC (minimum required capital) after of the reform is +12.6% across all banks. For the sub-sample of large and internationally active banks (Group 1) the impact is +13.3%. For Group 2 banks the impact amounts to +8.9%.

• The full implementation findings follow the anticipated choice by the EU to set ILM (internal loss multiplier) = 1 for operational risk when implementing the Basel III framework.

• The estimation referring to market risk impact adjusts the bias that results from overly conservative original data submissions on market risk by several banks, among which six G-SIIs (global systemically important institutions).

• After applying the EIF (equity investment in funds) adjustment, the estimated market risk impact is 1.2% on the entire sample.

• Full implementation of Basel III results in a total CET1 capital shortfall of EUR 0.2 billion, which can be attributed fully to Group 2 banks.

• When considering the full sample of banks, the risk based CET1 ratio drops by 210 basis points as a result of the revised Basel III framework. The broader measures Tier 1 and Total Capital Ratios declined by 220 and 270 basis points, respectively, following the implementation of the reform.

• Finally, and in line with previous years, for the full sample of banks, the cumulative risk-based impact is partially offset by the negative (-3.8%) leverage ratio impact.

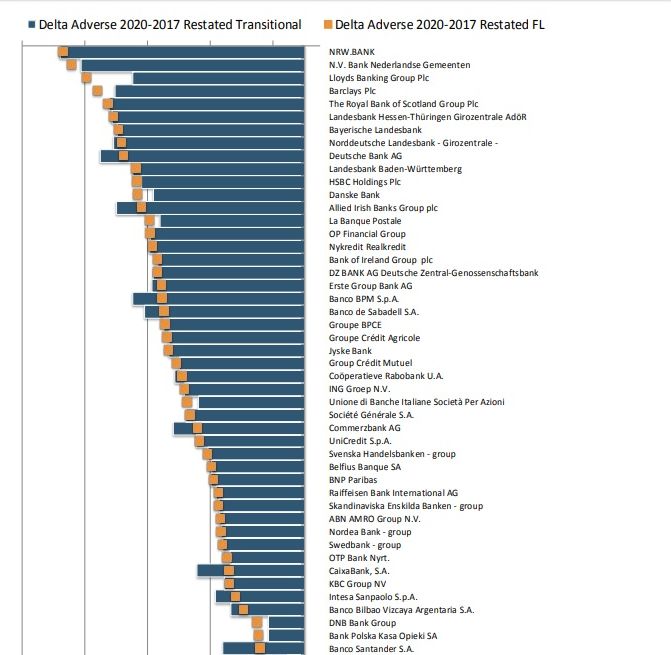

The EBA Report includes an Annex with an assessment of the impact of the Basel III framework taking into account EU specific adjustments. The considered adjustments are part of either the current CRR 2/CRD 5 framework or the different CRR 3/CRD 6 proposals to that are part of the EU Basel III implementation.

Conclusions

The Report provides a comprehensive overview of Basel III’s complex effects on European banks, emphasizing the need for careful consideration and ongoing monitoring as these reforms shape the financial landscape.

The revisions to the Basel III framework mostly affect exposures and the resulting risk-weighted assets (RWA) and minimum required capital (MRC) for credit risk, operational risk (OpRisk) and leverage ratio (LR). Importantly, the new Basel III framework also introduces an aggregate output floor. The impact attributed to the above risk factors is measured and analyzed primarily in terms of MRC and secondarily

in terms of capital shortfalls and differentials in capital and leverage ratio.

COMMENTS