One year into the COVID-19 pandemic, the accumulating human toll continues to raise concerns, even as growing vaccine coverage lifts sentiment. High uncertainty surrounds the global economic outlook, primarily related to the path of the pandemic. The contraction of activity in 2020 was unprecedented in living memory in its speed and synchronized nature. But it could have been a lot worse. Although difficult to pin down precisely, IMF staff estimates suggest that the contraction could have been three times as large if not for extraordinary policy support. Much remains to be done to beat back the pandemic and avoid divergence in income per capita across economies and persistent increases in inequality within countries.

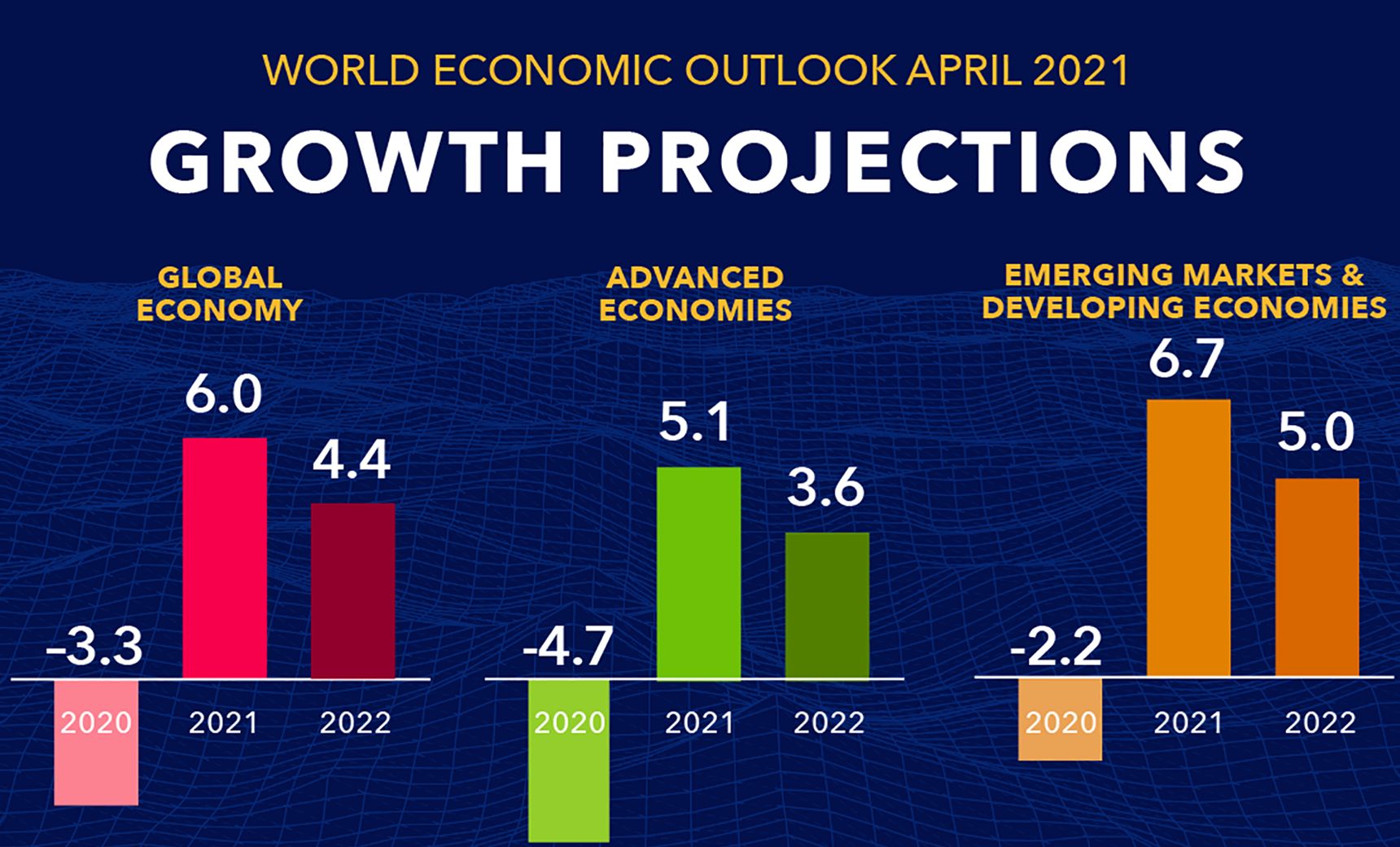

Improved outlook: After an estimated contraction of –3.3 percent in 2020, the global economy is projected to grow at 6 percent in 2021, moderating to 4.4 percent in 2022. The contraction for 2020 is 1.1 percentage points smaller than projected in the October 2020 World Economic Outlook (WEO), reflecting the higher-than-expected growth outturns in the second half of the year for most regions after lockdowns were eased and as economies adapted to new ways of working.

The projections for 2021 and 2022 are 0.8 percentage point and 0.2 percentage point stronger than in the October 2020 WEO, reflecting additional fiscal support in a few large economies and the anticipated vaccine-powered recovery in the second half of the year. Global growth is expected to moderate to 3.3 percent over the medium term—reflecting projected damage to supply potential and forces that predate the pandemic, including aging-related slower labor force growth in advanced economies and some emerging market economies. Thanks to unprecedented policy response, the COVID-19 recession is likely to leave smaller scars than the 2008 global financial crisis. However, emerging market economies and low-income developing countries have been hit harder and are expected to suffer more significant medium-term losses.

Divergent impacts: Output losses have been particularly large for countries that rely on tourism and commodity exports and for those with limited policy space to respond. Many of these countries entered the crisis in a precarious fiscal situation and with less capacity to mount major health care policy responses or support livelihoods. The projected recovery follows a severe contraction that has had particularly adverse employment and earnings impacts on certain groups. Youth, women, workers with relatively lower educational attainment, and the informally employed have generally been hit hardest. Income inequality is likely to increase significantly because of the pandemic. Close to 95 million more people are estimated to have fallen below the threshold of extreme poverty in 2020 compared with pre-pandemic projections.

Moreover, learning losses have been more severe in low-income and developing countries, which have found it harder to cope with school closures, and especially for girls and students from low-income households. Unequal setbacks to schooling could further amplify income inequality.

High uncertainty surrounds the global outlook. Future developments will depend on the path of the health crisis, including whether the new COVID-19 strains prove susceptible to vaccines or they prolong the pandemic; the effectiveness of policy actions to limit persistent economic damage (scarring); the evolution of financial conditions and commodity prices; and the adjustment capacity of the economy. The ebb and flow of these drivers and their interaction with country-specific characteristics will determine the pace of the recovery and the extent of medium-term scarring across countries.

In many aspects, this crisis is unique. In certain countries, policy support and lack of spending opportunities have led to large increases in savings that could be unleashed very quickly should uncertainty dissipate.

At the same time, it is unclear how much of these savings will be spent, given the deterioration of many firms’ and households’ balance sheets (particularly among those with a high propensity to consume out of income) and the expiration of loan repayment moratoria. In sum, risks are assessed as balanced in the short term, but tilted to the upside later on. Considering the large uncertainty surrounding the outlook, policymakers should prioritize policies that would be prudent, regardless of the state of the world that prevails—for instance, strengthening social protection with wider eligibility for unemployment insurance to cover the self-employed and informally employed; ensuring adequate resources for health care, early childhood development programs, education, and vocational training; and investing in green infrastructure to hasten the transition to lower carbon dependence.

Moreover, they should be prepared to flexibly adjust policy support, for example, by shifting from lifelines to reallocation as the pandemic evolves, and linked to improvements in activity, while they safeguard social spending and avoid locking in inefficient spending outlays. It is important to anchor short-term support in credible medium-term frameworks (see the April 2021 Fiscal Monitor). Where elevated debt levels limit scope for action, effort should also be directed at creating space through increased revenue collection (fewer breaks, better coverage of registries, and switching to well-designed value-added taxes), greater tax progressivity, and by reducing wasteful subsidies.

Policy priorities: The factors shaping the appropriate stance of policy vary by country, especially progress toward normalization. Hence, countries will need to tailor their policy responses to the stage of the pandemic, strength of the recovery, and structural characteristics of the economy. Once vaccination becomes widespread and spare capacity in health care systems is generally restored to pre-COVID-19 levels, restrictions can begin to be lifted. While the pandemic continues, policies should first focus on escaping the crisis, prioritizing health care spending, providing well-targeted fiscal support, and maintaining accommodative monetary policy while monitoring financial stability risks. Then, as the recovery progresses, policymakers will need to limit long-term economic scarring with an eye toward boosting productive capacity (for example, public investment) and increasing incentives for an efficient allocation of productive resources. It is a delicate balance, especially given the prevailing uncertainty.

Therefore, when support is eventually scaled back, it should be done in ways that avoid sudden cliffs (for instance, gradually reducing the government’s share of wages covered under furlough and short-time work programs while increasing hiring subsidies to enable reallocation as needed). All the while, long-term challenges—boosting productivity, improving policy frameworks, and addressing climate change—cannot be ignored. Differential recovery speeds across countries may give rise to divergent policy stances, particularly if advanced economies benefit sooner than others from wide vaccine coverage. Clear forward guidance and communication from advanced economy central banks is particularly crucial, and not just for calibrating the appropriate domestic monetary accommodation. It also vitally bears on external financial conditions in emerging markets and the impact that divergent policy stances have on capital flows.

Strong international cooperation is vital for achieving these objectives and ensuring that emerging market economies and low-income developing countries continue to narrow the gap between their living standards and those of high-income countries. On the health care front, this means ensuring adequate worldwide vaccine production and universal distribution at affordable prices—including through sufficient funding for the COVAX facility—so that all countries can quickly and decisively beat back the pandemic. The international community also needs to work together to ensure that financially constrained economies have adequate access to international liquidity so that they can continue needed health care, other social, and infrastructure spending required for development and convergence to higher levels of income per capita. Countries should also work closely to redouble climate change mitigation efforts. Moreover, strong cooperation is needed to resolve economic issues underlying trade and technology tensions (as well as gaps in the rules-based multilateral trading system). Building on recent advances in international tax policy, efforts should continue to focus on limiting cross-border profit shifting, tax avoidance, and tax evasion.

COMMENTS